The Bitcoin value has began the week on a optimistic notice, after witnessing downturn momentum on Tuesday, Might 7. Notably, the value of the most important crypto by market, together with a number of different main altcoins, has gone by way of a tumultuous street in latest weeks because of a flurry of causes. For example, the numerous outflow from the U.S. Spot Bitcoin ETF has weighed on the feelings.

So, let’s take a have a look at the elements which have to this point impacted the Bitcoin value, and the way it could carry out in the long run.

Elements Impacting Bitcoin Value:

The Bitcoin value was largely impacted this yr because of U.S. Spot Bitcoin ETF approval, the Fed’s coverage fee stance, and the Bitcoin Halving. Right here we take a fast recap of the yr.

Bitcoin ETF Hype

The Bitcoin value has famous optimistic buying and selling since final yr, as traders had been anticipating the Bitcoin ETF. Notably, the approval of the U.S. Spot Bitcoin ETF in January has bolstered traders’ confidence. As well as, the optimistic inflow into the funding instrument has additionally fuelled the market sentiment.

In the meantime, the immense success of the Bitcoin ETFs has additionally despatched the BTC value to its all-time excessive in mid-March. Concurrently, the latest approval of the Spot ETF in Hong Kong has additional bolstered confidence, whereas reflecting the the rising institutional confidence within the sector.

Federal Reserve’s Curiosity Fee

The Federal Reserve’s stance with their coverage charges has additionally weighed on the feelings to this point this yr. For context, the market was anticipating round 5 fee cuts by way of the yr, whereas anticipating the inflation to chill.

Nonetheless, the financial knowledge has proven that inflation has stayed sturdy whereas dampening hopes over potential fee cuts this yr. Now, a flurry of analysts predict a single or two fee cuts by way of the yr. In addition to, some have additionally put their bets on no change within the coverage charges in 2024.

Additionally Learn: Bitcoin-based Apps Contributing Significant Portion of Miners’ Income

Bitcoin Halving

The Bitcoin Halving is without doubt one of the key occasions the market was ready for in 2024. The latest Halving occasion has to this point fuelled the confidence of the market members, given its potential influence on the BTC in earlier occasions.

Traditionally, the Bitcoin Halving occasion has triggered a big rally within the BTC value, sending it to a brand new excessive. Contemplating that the market was additionally bullish in the direction of the flagship crypto. Nonetheless, a number of market pundits recommended a short-term volatility after the halving, whereas sustaining an upward trajectory for the long run.

Now that we now have gone by way of a few of the fundamental elements which have impacted the BTC efficiency considerably, let’s have a look at how the Bitcoin value may carry out within the coming days.

Will Bitcoin Value Stay Secure In August?

Rekt Capital, a distinguished crypto market analyst, supplies insights into Bitcoin’s potential peak within the present cycle. Analyzing historic developments, he suggests Bitcoin may peak between mid-December 2024 and early March 2025.

Nonetheless, he additionally famous that the continuing deceleration within the cycle could result in a resynchronization with conventional Halving cycles. As Bitcoin consolidates, the potential for stability and resynchronization will increase, impacting its peak timeframe.

Notably, the analyst highlights that Bitcoin’s efficiency past previous All-Time Highs has traditionally lengthened, suggesting an extended Bull Market Peak timeframe. With these elements in thoughts, traders anticipate stability and potential peak changes within the coming months, influencing Bitcoin’s value trajectory in August 2024.

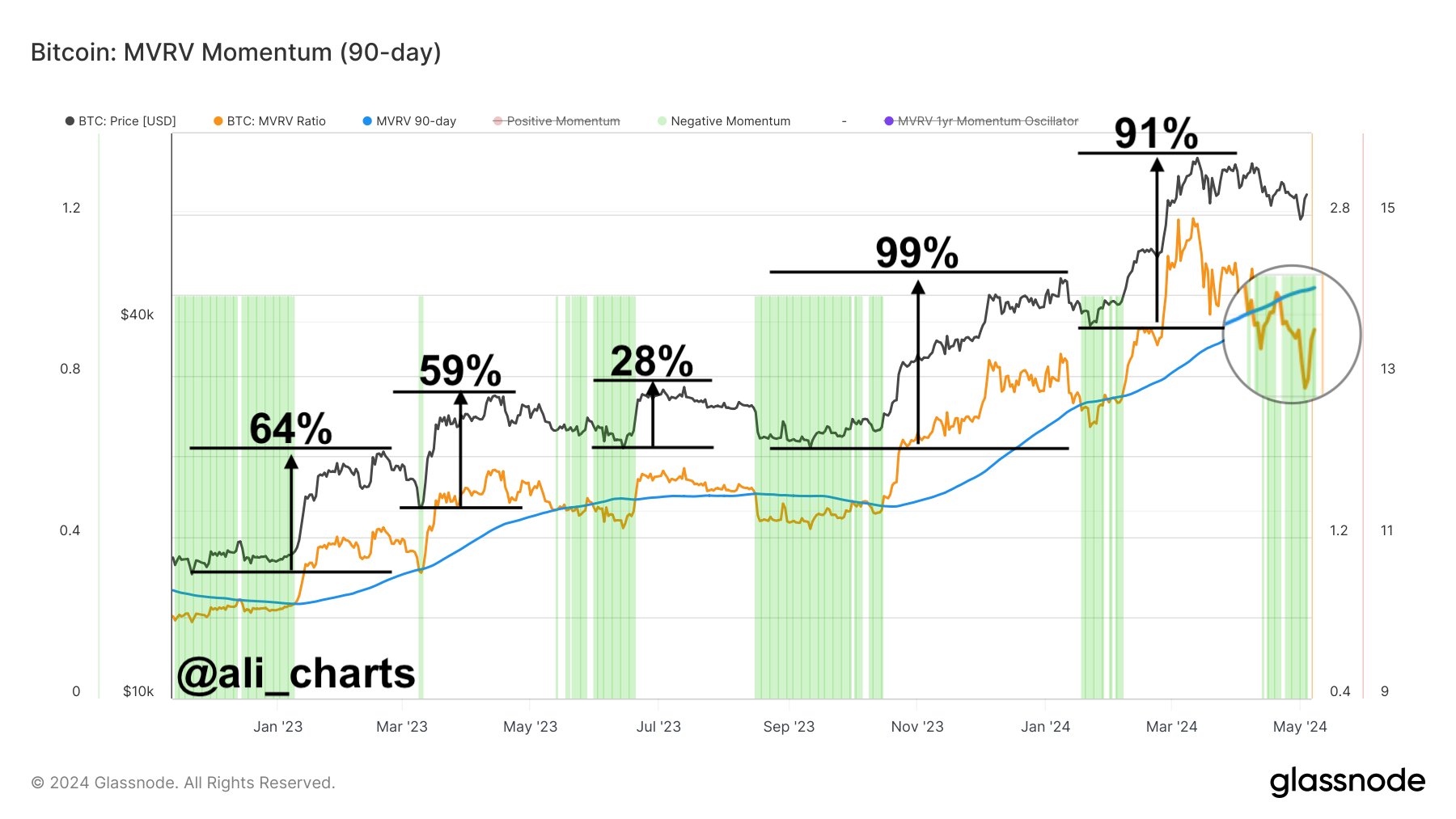

As well as, one other market professional, Ali Martinez stated that regardless of the latest development in Bitcoin value this week, the “MVRV 90-Day Ratio” means that Bitcoin remains to be beneath a “prime purchase zone.” This has additionally fuelled the confidence of the traders, over a possible stability within the BTC’s trajectory within the coming days.

Concurrently, the latest U.S. Job data confirmed that the inflation stress has cooled, though it nonetheless stayed above the Fed’s 2% goal vary. On condition that, some have raised their bets over a possible fee lower in July. Notably, such an element, if occurs, may probably enhance the traders’ sentiment, and assist Bitcoin keep stability in August.

In the meantime, as of writing, the Bitcoin price was down 1.10% and traded at $63,585.38, whereas its buying and selling quantity rose 67.61% to $30.56 billion. Nonetheless, the crypto has touched a excessive of 65,494.90 within the final 24 hours.

Additionally Learn: Pepe Coin Whale Dumps 1 Tln PEPE Amid 5% Price Drop, What’s Next?

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: