Over the past month of Could, the Ethereum (ETH) value clocked a robust 27% acquire with most of them coming within the final ten days following the approval of the spot Ethereum ETF. Whereas ETH consolidates round $3,800 ranges, on-chain developments recommend a significant value enhance going forward.

Ethereum Whale and Institutional Curiosity Rising

As per information from CryptoQuant, ever for the reason that approval of the spot Ethereum ETF on Could 23, greater than 800,000 Ethereum cash have moved off exchanges within the final ten days. CryptoQuant experiences that both whales or establishments have been making ready for the spot Ethereum ETF to go stay for buying and selling.

Thus, this specific investor cohort might be behind transferring these ETH off exchanges thus transferring them to self-custody. This decrease change provide is a bullish indicator since fewer cash can be out there for promoting. moreover, the proportion of Ethereum provide on the change has dropped to the bottom in a few years, presently at 10.6%.

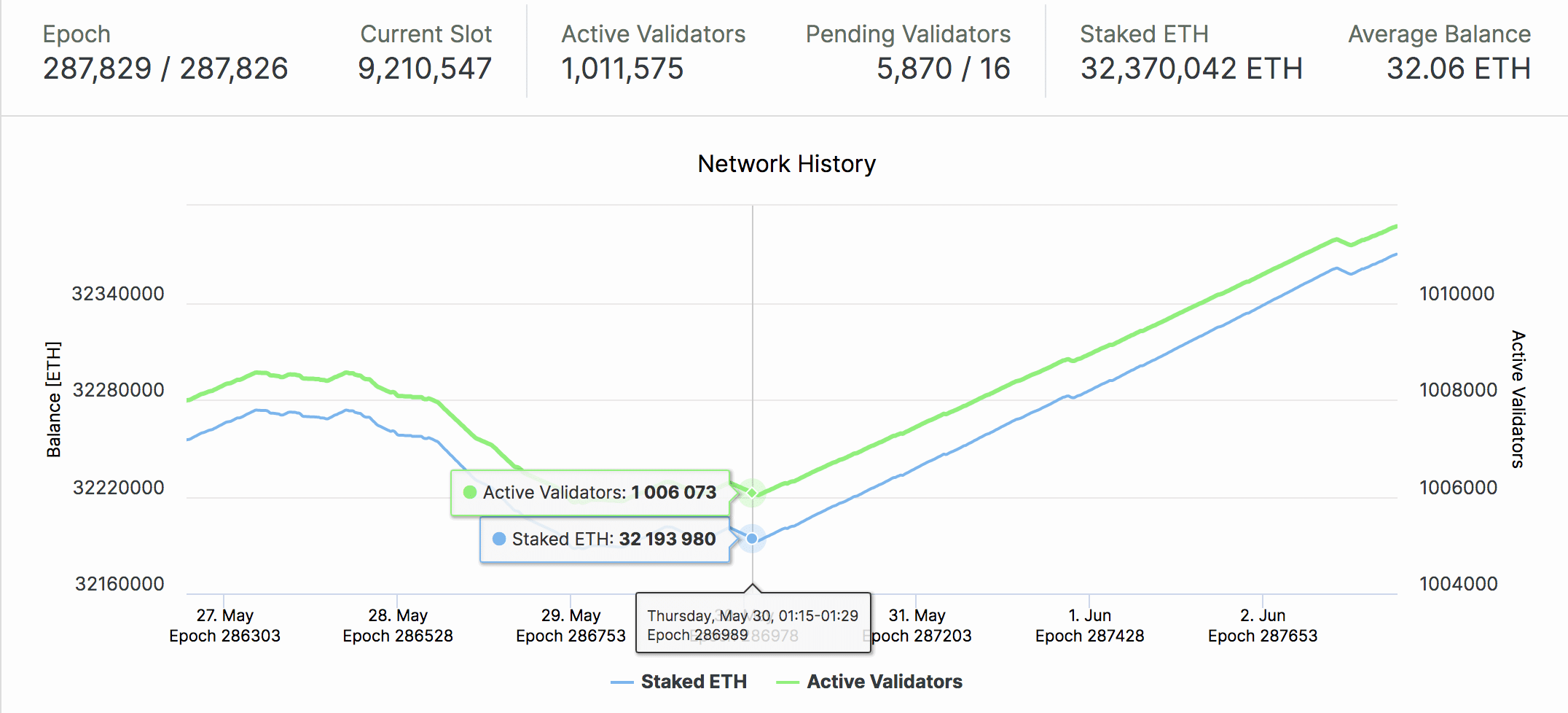

Moreover, the beacon-chain information exhibits that the Ethereum staking exercise has picked up tempo once more since Could 30. Ranging from Could 30, a major variety of traders initiated coin staking actions following a three-day interval of withdrawals. This withdrawal streak led to the entire staked quantity dropping to a weekly low of 32,193,980 ETH.

Previously 72 hours alone, staking deposits on the beacon chain elevated by 175,358 ETH. At current market costs, these just lately staked cash maintain a worth of roughly $661 million.

ETH Value To New All-Time Excessive

After final week’s sell-off, the Ethereum (ETH) price has been holding robust assist at $3,750 and faces resistance at $3,830 on the upside. As soon as it crosses this, the ETH value might be eyeing a transfer above $4,000 and additional to its new all-time excessive ranges.

Final week, Bloomberg’s ETF analyst Eric Balchunas said that there’s a legit risk of getting the spot Ethereum ETF permitted by June finish. Moreover, some market analysts additionally consider that the ETH value might break previous its all-time excessive of $,4870 as soon as the spot Ethereum ETF begins buying and selling, amid the demand strain, just like what occurred after the Bitcoin ETF launch. Nevertheless, some market analysts consider that the Ethereum ETF will see solely 20% inflows to that of spot Bitcoin ETFs.

However, traders would have some considerations about Grayscale’s Ethereum Belief (ETHE). If ETHE, with over $11 billion in AUM, turns into a spot Ethereum ETF, it might additionally face outflows just like GBTC.

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: