Crypto and monetary markets, normally, are reeling from renewed volatility and mounting geopolitical strain. Because of this, hypothesis is intensifying round whether or not the Federal Reserve (Fed) will pivot again towards Quantitative Easing (QE).

A possible QE could be paying homage to the aggressive financial interventions of 2008 and 2020. For crypto, the implications may very well be monumental, with many merchants bracing for a possible V-shaped restoration and a historic rally if QE is revived.

Analysts Share Indicators Why the FED May Act

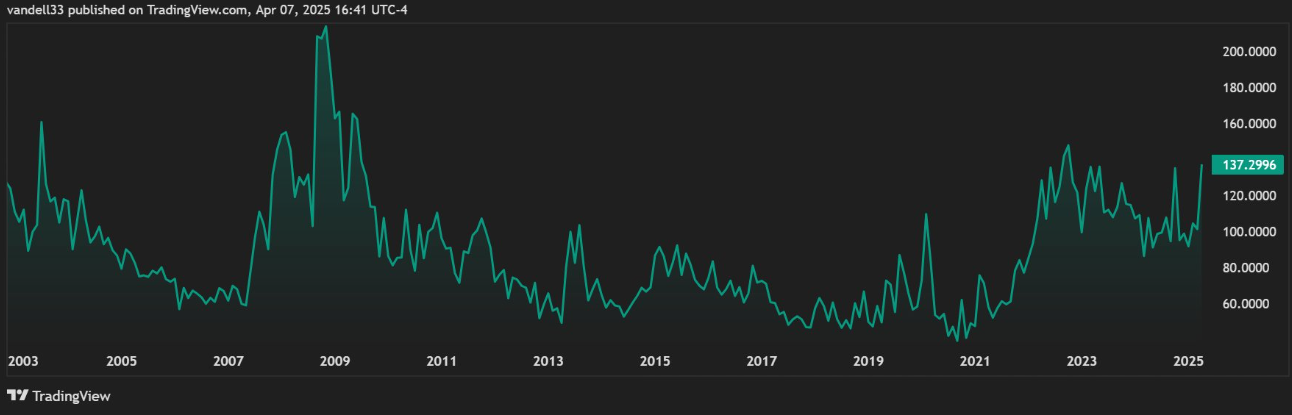

Analysts have shared causes that would immediate the Fed to intervene, with one citing the MOVE Index. That is Wall Avenue’s “worry gauge” for the bond market. At 137.30, the index is at the moment throughout the 130–160 vary the place the Fed has traditionally acted throughout crises.

“Now it’s at 137.30, within the 130–160 vary the place the Fed may step in, relying on the economic system. In the event that they don’t, they’ll nonetheless lower charges quickly as a result of they must refinance the debt to maintain the Ponzi going,” wrote Vandell, co-founder of Black Swan Capitalist.

This sign aligns with different warning indicators of monetary instability, together with world market sell-offs that set the tone for the crypto black Monday narrative. This prompted the Fed to schedule a closed-door board meeting on April 3.

In response to analysts, this timing was not random, with mounting strain prone to see the Fed cave and President Trump having his way.

“With the Fed hinting at QE, all the things adjustments Threat: Reward is now in favor of the bulls. Look ahead to uneven worth motion, however don’t miss the restoration rally. And keep in mind… it’s simpler to commerce this market than to carry by means of it,” said Aaron Dishner, a crypto dealer and analyst.

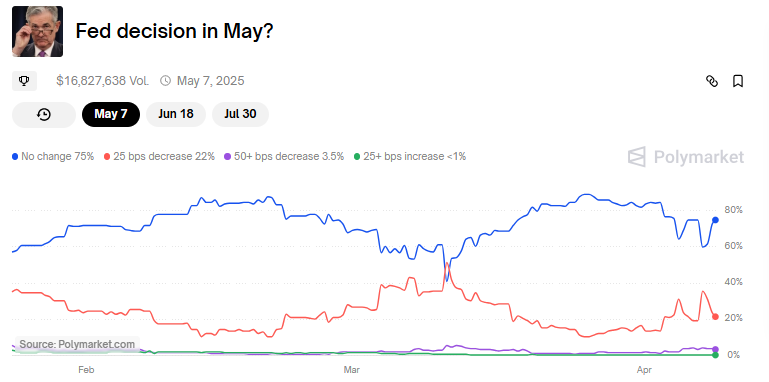

This means that traders are studying between the strains, significantly with the Fed’s subsequent scheduled coverage resolution not till Might 6–7. JPMorgan lately grew to become the first Wall Street bank to forecast a US recession amid Donald Trump’s proposed tariffs, including urgency to the dialog.

The financial institution suggests the Fed could also be pressured to behave sooner, presumably with charge cuts and even QE, earlier than the scheduled FOMC assembly. In opposition to this backdrop, crypto investor Eliz shared a provocative take.

“I truthfully suppose Trump is doing all this to hurry up the Fed’s course of to decrease charges and QE,” they noted.

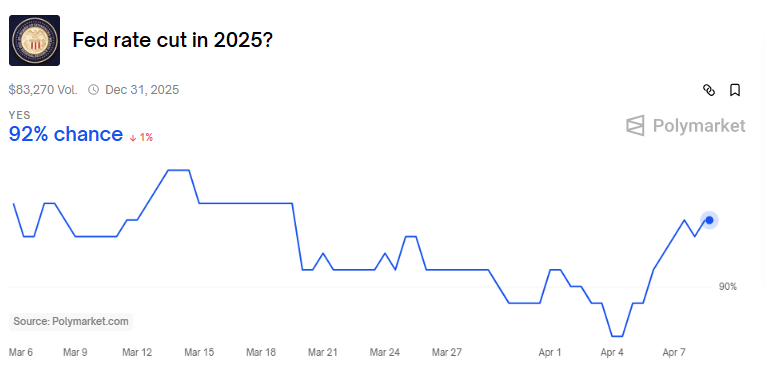

That will not be far-fetched provided that the Fed should additionally handle over $34 trillion in federal debt. Noteworthy, this turns into tougher to service at increased rates of interest. In response to Polymarket, there’s now a 92% probability the Fed will lower charges sooner or later in 2025.

Why Crypto May Profit From QE

Ought to QE materialize, historical past suggests crypto may very well be one of many greatest beneficiaries. BitMEX founder and former CEO Arthur Hayes predicted that QE may inject as much as $3.24 trillion into the system, almost 80% of the quantity added through the pandemic.

“Bitcoin rose 24x from its COVID-19 low because of $4 trillion in stimulus. If we see $3.24 trillion now, BTC may hit $1 million,” he said.

This aligns together with his latest prediction that Bitcoin could reach $250,000 by year-end if the Fed shifts to QE to help markets.

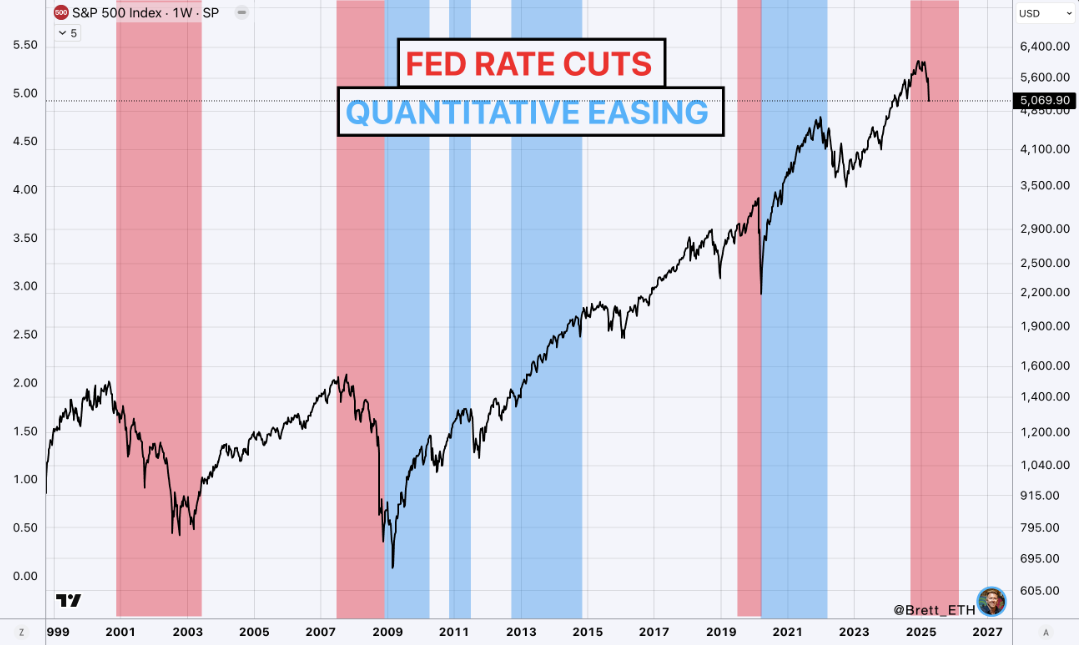

Analyst Brett supplied a extra measured view, noting that QE usually follows charge cuts relatively than precedes them.

“We’re doubtless going to see charge cuts by means of mid-2026…like in 2008 and 2020, Powell has mentioned QE doesn’t come till charge cuts are full,” Brett explained.

Based mostly on this, the analyst dedicated to purchasing selectively however didn’t anticipate a V-shaped bounce except one thing drastic modified.

That “one thing” may very well be Trump reversing his tariffs or the Fed entrance operating a recession with emergency easing measures. If both occurs, the crypto market may rally exhausting and quick.

Altseason on the Horizon?

In the meantime, Our Crypto Speak says a Quantitative Easing in Might may lay the groundwork for a potential altcoin season.

Their forecast echoes earlier cycles the place QE triggered explosive strikes in threat belongings. When QE kicked off in March 2020, altcoins surged over 100X by the point it resulted in 2022.

Merchants are actually eyeing Might as a possible kickoff for the following liquidity wave, with bettors wagering a 75% probability the Fed will maintain charges regular. If these odds shift, merchants anticipate the cash printer to observe.

Whereas some anticipate extra worth “chop” within the brief time period, most agree that the long-term setup is more and more favorable.

“If QE actually kicks off in Might, this chop is simply the calm earlier than the giga pump,” wrote MrBrondorDeFi on X.

Even when quantitative easing doesn’t happen instantly, confidence stays robust that it’ll occur this 12 months.

“Perhaps not Might, then later. It can occur this 12 months, which is sweet for one more rally and new highs,” Our Crypto Speak added.

Due to this fact, the buck stops with the Fed. Whether or not it’s charge cuts, QE, or each, the implications for crypto are monumental.

If historical past repeats and the Fed opens the liquidity floodgates once more, Bitcoin and altcoins may very well be poised for a historic breakout. This might eclipse the features seen through the 2020-2021 bull run.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.