Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

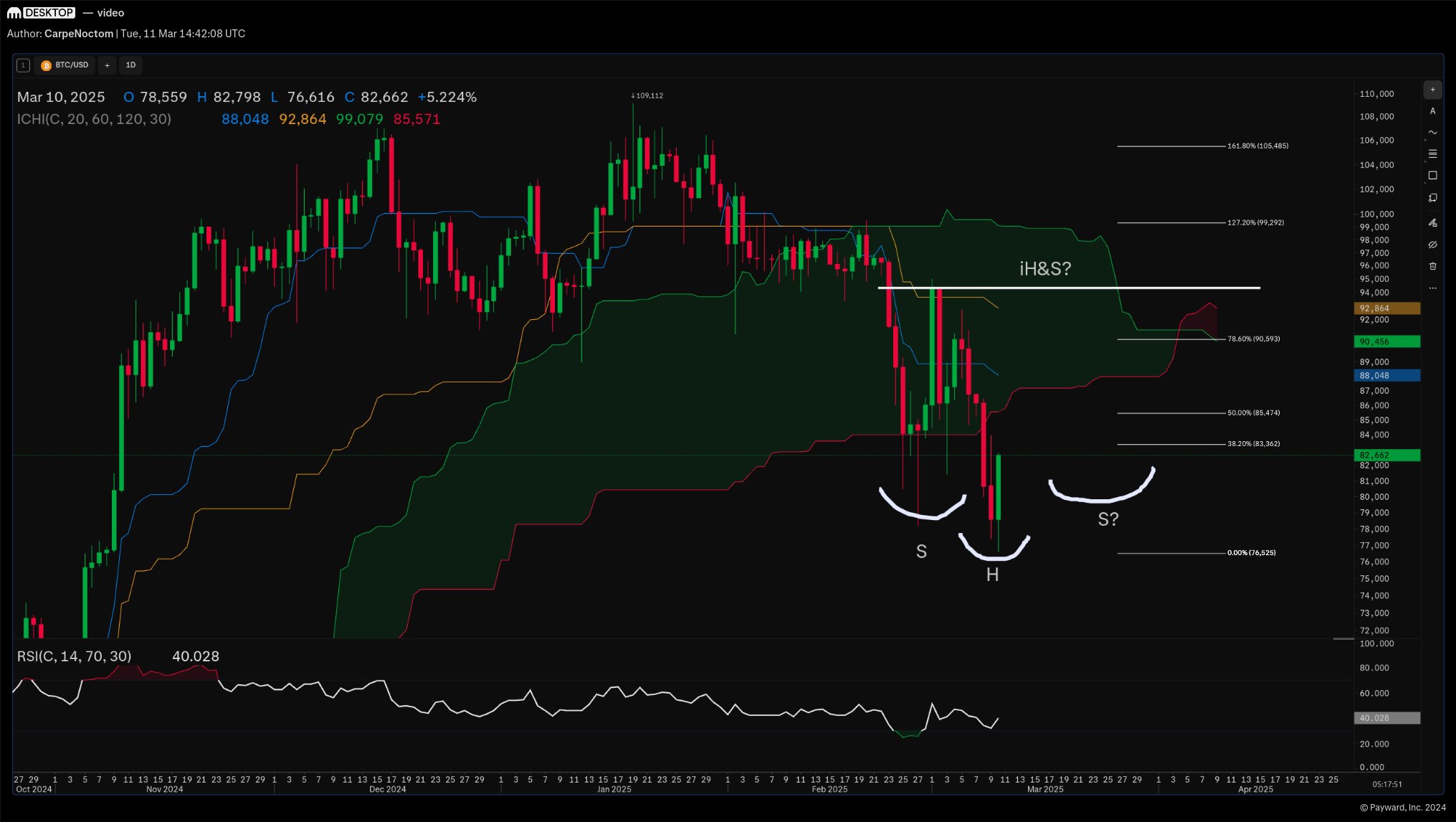

Bitcoin (BTC) stays at a essential juncture, holding above its yearly pivot stage. In his newest market evaluation, seasoned crypto dealer Josh Olszewicz outlined key technical elements that might decide Bitcoin’s subsequent transfer in his newest video evaluation, emphasizing the significance of RSI divergences, quantity traits, and candlestick formations.

With BTC experiencing heavy downward strain over the previous few weeks, Olszewicz examined whether or not the market has reached an exhaustion level for sellers or if additional draw back stays possible.

Is The Bitcoin Backside In?

An important commentary in Olszewicz’s evaluation is the presence of bullish divergence on each RSI and quantity, a sample that traditionally indicators a possible development reversal. He famous: “BTC for the second is holding on the yearly pivot, it’s holding on the OG Pitchfork right here, and we did put in a bullish divergence on each RSI and quantity. We received a decrease low in value, greater low in RSI on decrease quantity.”

Associated Studying

This setup mirrors comparable circumstances noticed in August and September, the place Bitcoin noticed comparatively equal lows in value, however RSI shaped considerably greater lows. Whereas this doesn’t assure an imminent reversal, Olszewicz identified that it will increase the likelihood of a possible upside transfer, particularly if additional confirmations come up.

From a candlestick perspective, Bitcoin’s value motion is exhibiting early indicators of potential stabilization. Olszewicz highlighted the importance of Dragonfly Doji formations, notably together with bullish engulfing candles, which frequently sign vendor exhaustion and development reversals.

“What I might like to see on many of those charts is what we’re already seeing on the day by day—a inexperienced Dragonfly candlestick. It’s a small physique with a protracted wick, exhibiting clear rejection of decrease costs. If confirmed, this might be an early bottoming sign.”

Nevertheless, he cautioned that whereas these patterns might be indicative of a shift in market sentiment, they aren’t foolproof and require extra affirmation from value construction and momentum indicators. Furthermore, Olszewicz added through X: “BTC iHS brewing? Method too early to name this definitively however we’ve received the early trappings of a multi-week backside right here. Would align with a possible kumo breakout in Q2 and measures to an ATH retest. One thing to watch all through March, a brand new LL would possible negate this chance.”

Olszewicz suggested merchants to stay disciplined and keep away from over-leveraging positions in unstable circumstances. He harassed the significance of sustaining a constant commerce sizing technique and avoiding emotional decision-making. “You don’t need to make all of it again in a single commerce. You don’t need to revenge commerce. Confidence drops in instances of chaos, and that’s when most individuals make errors.”

Associated Studying

He additionally warned towards blindly dollar-cost averaging into property just because they seem closely discounted: “Simply because one thing is down 80% doesn’t imply it’s an computerized purchase. The technicals would possibly look nice right now, however that doesn’t imply it received’t maintain going decrease. That’s why threat administration is vital.”

Whereas the broader macroeconomic landscape stays unsure—with ongoing tariff concerns and combined indicators from conventional markets—Bitcoin’s technical positioning suggests {that a} potential reduction rally might emerge within the coming months.

Olszewicz steered that March and April might be pivotal durations for Bitcoin, the place a clearer development might develop. Nevertheless, he reiterated that for now, merchants ought to concentrate on high-probability setups reasonably than speculative performs. “If BTC can stabilize right here and reclaim key ranges, the case for a stronger restoration into Q2 strengthens. However it’s too early to make that decision. Proper now, the very best technique could merely be to attend for high-confidence setups.”

At press time, BTC traded at $81,599.

Featured picture created with DALL.E, chart from TradingView.com