WLFI is making waves in the neighborhood after proposing to make use of 100% of treasury liquidity charges for token buyback. This initiative, which entails burning the tokens, creates a strong deflationary mechanism.

If carried out successfully, this technique may function a “weapon” to strengthen WLFI’s worth whereas boosting confidence in its community-driven governance mannequin.

Worth-Boosting Mechanism

The World Liberty Financial (WLFI) group unveiled a vital proposal: WLFI will use 100% of the charges generated from protocol-owned liquidity (POL) to repurchase WLFI on the open market. The repurchased tokens will then be despatched to a burn tackle, completely eradicating them from circulation.

This proposal goals to immediately cut back circulating provide, improve the relative advantages for long-term holders, and switch protocol utilization right into a deflationary driver below the precept of “the extra you utilize, the extra will get burned.”

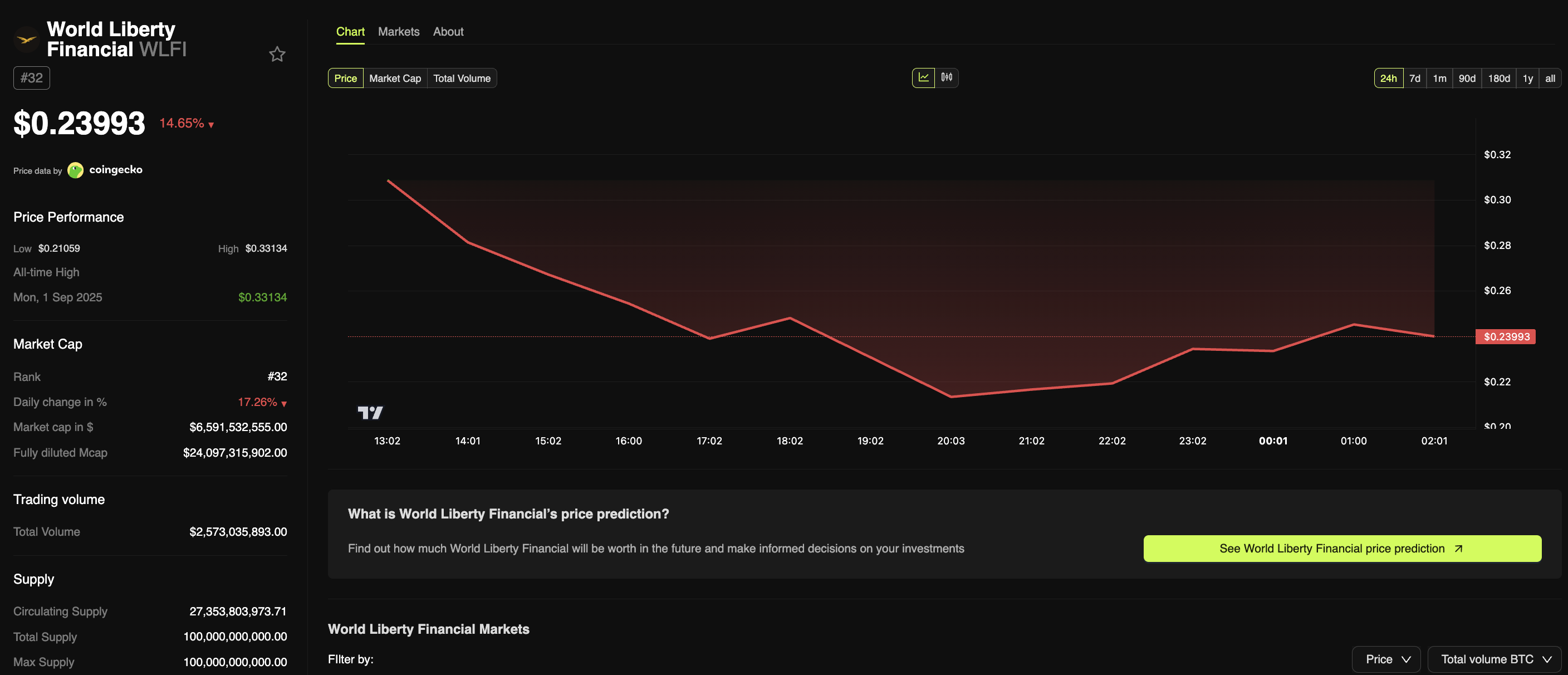

WLFI solely lately began trading. Information from BeInCrypto Market exhibits the token’s most provide is capped at 100 billion, with round 24.7 billion WLFI at the moment in circulation. WLFI is buying and selling at $0.24, down 26% from its all-time excessive just some hours earlier.

From a tokenomics perspective, the buyback-and-burn technique funded by POL charges creates a constructive suggestions loop. As protocol utilization will increase, POL charges develop, resulting in larger buybacks and a steadily shrinking circulating provide. This dynamic may generate long-term value help if demand stays steady or rises.

By proscribing the mechanism to protocol-owned liquidity, WLFI additionally avoids harming third-party LPs and stopping conflicts of curiosity. Moreover, the on-chain transparency of burn transactions gives a robust layer of accountability for group oversight.

In fact, not everybody may be very optimistic concerning the effectiveness of this proposal. The price and the valuation points from launch have triggered some group members to lose religion within the undertaking.

“You’ve defrauded tens of millions of individuals all over the world and are actually residing in luxurious in America with that cash. This undertaking will mark the downfall of the Trump household, and on this market, nobody will ever belief your phrases once more.” An X person immediately blamed Donald Trump.

Terra Luna Additionally Had the Buyback System

There are potential dangers. First, the size of POL charges within the early phases may be comparatively small. If low buying and selling volumes on POL swimming pools, the buybacks might not meaningfully influence WLFI’s circulating provide.

Second, allocating 100% of charges to burning might pressure the treasury’s working and reserve funds. If the protocol fails to create different income sources, this might influence product growth and reinvestment capability.

As well as, buyback operations may set off excessive volatility in periods of low liquidity, creating alternatives for front-running or short-term manipulation. Due to this fact, clear guidelines on execution strategies, reporting mechanisms, and fallback methods in case of declining POL charges are vital to make sure sustainable implementation.

The self-buyback technique is ㅜ within the cryptocurrency market, as Chainlink (LINK), Pump.fun (PUMP), and others have already proven.

Nevertheless, not all initiatives that apply it are profitable, and Terra Luna 2.0 is a typical instance. The influence of the earlier crash in 2022, mixed with an ample complete provide and a low burn charge, makes it troublesome for the LUNA 2.0 value to get better.

Due to this fact, the WLFI group wants so as to add guardrails on treasury governance, clear shopping for mechanisms, and a transparent roadmap to change into a sustainable measure. This system can enhance tokenomics and exhibit efficient group governance if these are accomplished.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.