XRP value is delicately balancing on the road that would decide if bulls get a breakout or a sell-off ensues. The sixth-largest crypto boasting $25 billion in market capitalization with $544 in buying and selling quantity, is up 0.1% to $0.4759.

Its friends, the likes of Bitcoin and Ethereum, are up 0.5% and 0.3%, respectively, on the day the U.S. Consumer Price Index (CPI) data comes out. The Federal Reserve will depend on the CPI and different financial indicators to gauge the extent of inflation and modify financial coverage accordingly.

If the CPI drops to the anticipated 3% vary, threat belongings like BTC, ETH, XRP, and shares might lastly purchase sufficient momentum to renew paused rallies as buyers’ threat urge for food will increase.

The scenario might be barely extra worrying for XRP price, particularly after LBRY misplaced the lawsuit against the Securities and Exchange Commission (SEC).

Is An XRP Value Breakout In The Offing?

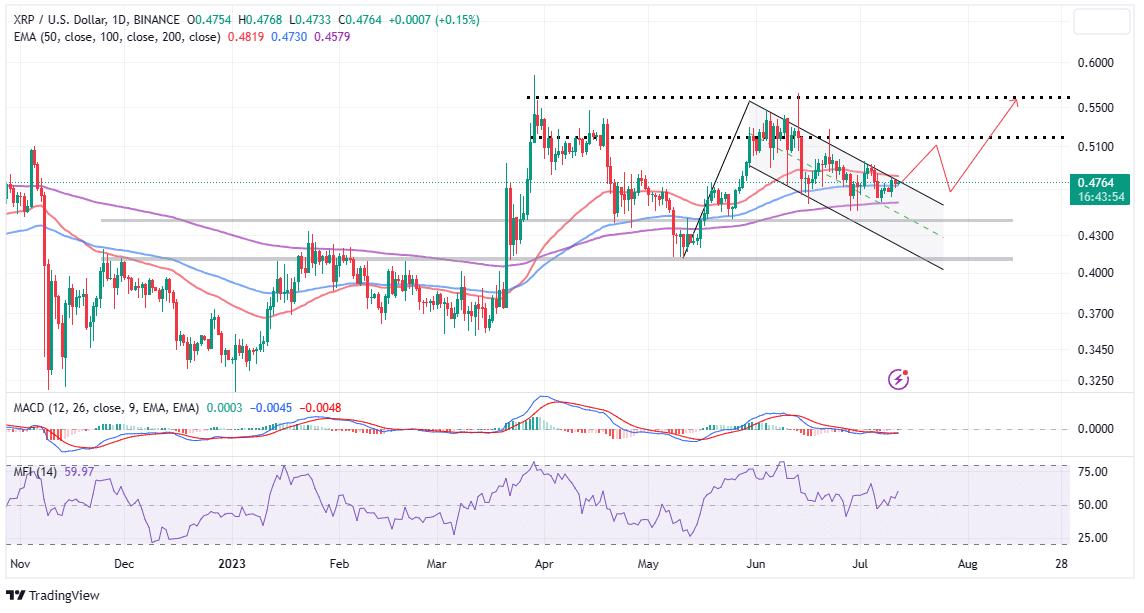

XRP is on the verge of a bullish breakout concentrating on highs round $0.55 within the quick time period. The presence of a bull flag sample on the day by day chart implies that with a minor push above the short-term hurdle at $0.48, XRP value may validate the uptick.

The 100-day Exponential Transferring upholds XRP’s present place by offering help at $0.4730. On the upside, weakening the flag’s resistance at $0.48 would propel the value above $0.50, thus bringing the goal at $0.55 inside attain.

Reinforcing the bullish outlook in XRP is the soon-to-be-confirmed purchase sign from the Transferring Common Convergence Divergence (MACD) indicator. Merchants might wish to affirm that the MACD makes a bullish cross earlier than triggering their purchase orders.

The Cash Move Index (MFI) reveals that extra funds are beginning to move in XRP markets. In different phrases, as influx quantity enhance, momentum builds, paving the way in which for a restoration.

How LBRY Shedding Case Towards the SEC Might Complicate Issues for XRP

In a ruling made by US District Judge Paul J Barbadoro, LBRY, a cryptocurrency firm, was discovered to have disregarded the Securities Act. As an alternative of offering priority, crypto lovers concern the LBRY lawsuit may additional complicate the scenario for Ripple.

Decide Barbadoro dominated that LBRY will now not supply or take part within the sale of unregistered token securities along with a $111,614k civil penalty. In response to Jeremy Hogan, a Accomplice at Hogan & Hogan, it’s potential to see the same final result within the Ripple case.

“The ultimate ruling is out within the SEC v. LBRY case,” Hogan stated by way of a Twitter put up. “The Decide didn’t rule on secondary gross sales (or, not surprisingly, the Main Questions Doctrine). He enjoined additional violations and issued a penalty.”

Hogan argues that whereas such an final result is feasible, “the Courtroom must discover that there’s not sufficient to the Truthful Discover Protection to have a trial on the problem.” On high of this, “the Courtroom must discover that previous AND present sales of XRP are funding contracts in an effort to present injunctive aid.”

The injunctive aid could be a BIG downside for Ripple since it could enjoin gross sales from escrow. Nevertheless it’s an issue with a potential answer – only a workaround that may intervene with Ripple’s enterprise plans.

…

No ruling on secondary market gross sales is a “establishment” ruling.— Jeremy Hogan (@attorneyjeremy1) July 11, 2023

An injunctive aid could be dangerous information for Ripple because it “would enjoin gross sales from escrow.”

Associated Articles

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.