XRP holds within the inexperienced like a lot of its friends, following intently within the footsteps of Bitcoin. The most important cryptocurrency surged to $35,000 through the Asian enterprise hours on Tuesday amid hypothesis and optimism across the possible approval of BlackRock’s spot exchange-traded fund (ETF), upholding investor curiosity within the crypto market.

Up 4.3% within the final 24 hours, XRP price is buying and selling at $0.55. It has seen a substantial enhance in buying and selling quantity to $3.1 billion from barely $1 million lower than two weeks in the past. Essentially the most distinguished worldwide cash remittance token boasts $29 billion in market capitalization and ranks #5 amongst different cryptos, together with stablecoins.

Can XRP Value FOMO To $1

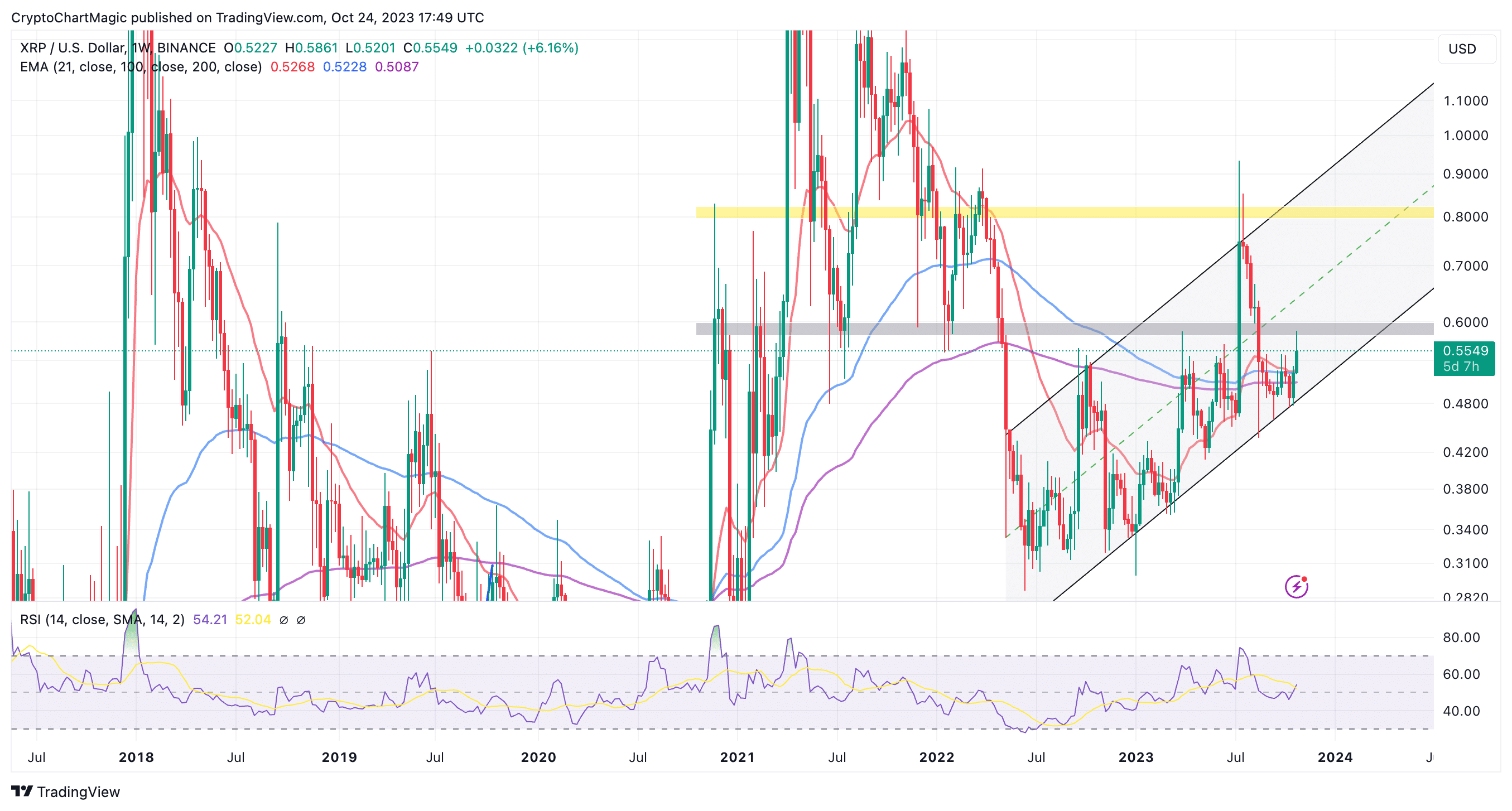

If curiosity in XRP continues forward of the willpower of the Ripple vs SEC lawsuit in 2024, traders may see a a lot bigger spike above $1. Crypto investor @jaydee_757, says that XRP is dangling under a macro trendline that has lasted greater than eight years.

A profitable break above this bearish trendline would set off the worry of lacking out (FOMO) and push XRP higher. Nonetheless, he cautions that “sensible cash” or traders who purchase through the bear market backside would leap in solely to pump the value and dump to revenue on earlier positions whereas “dump cash” — pushed by FOMO might be “considering they’re profitable” solely to lose.

#XRP – Take a step again & give attention to the Macro. We NEED to interrupt 8-year trendline!

If it breaks, Good cash will leap in for his or her profit! Dumb Cash will FOMO in considering they’re profitable LOL!

Within the END, Good Cash wins (once more), whereas Dumb cash get REKT (once more)! I am prepared!… pic.twitter.com/1ffY2JRdJB

— JD 🇵🇭 (@jaydee_757) October 24, 2023

Merchants with publicity to XRP longs might wish to preserve their purchase positions intact conscious that the token is sitting comfortably above the bull market indicators just like the 21-week Exponential Transferring Common (EMA) (pink), the 100-week EMA (blue) and the 200-week EMA (purple).

The affirmation of assist at $0.54 more likely to observe a day by day shut above the identical stage may sign the subsequent climb above $0.6.

With the Relative Power Index (RSI) at 54 exhibiting a bullish divergence, XRP value has a better chance to climb above $0.6 versus dropping to retest assist at $0.5.

XRP is more likely to have bottomed out at $0.3 paving the way in which for the bull run throughout the confines of the ascending channel. The channel’s assist is anticipated to maintain the draw back protected as bulls push to interrupt resistance on the center and higher boundaries.

Past $0.6 different key ranges merchants are required to remember for potential corrections are $0.8 and $1. However, dips under $0.5 may see XRP sweep liquidity on the native assist at $0.44 but when push involves shove, dips may lengthen to the realm between $0.34 and 0.38.

Nonetheless, such a transfer is very unlikely, particularly if Ripple keeps winning against the Securities and Exchange Commission (SEC) within the lawsuit awaiting trial in 2024.

Ripple Companions With Uphold To Improve Infrastructure

Ripple has announced a strategic partnership with Uphold, a worldwide Web3 platform, to enhance crypto liquidity for its cross-border funds infrastructure.

BIG NEWS: @Ripple Forges New Partnership with Uphold to Improve Underlying Crypto Liquidity Infrastructurehttps://t.co/1gJh95KDTQ pic.twitter.com/FLSDQxO0co

— Uphold (@UpholdInc) October 24, 2023

In line with Pegah Soltani, Ripple’s Head of Funds Product, the transfer will see the blockchain firm enhance its cross-border funds infrastructure by tapping “Uphold’s deep liquidity experience” which “additional underpins Ripple’s capability to supply quick and versatile cross-border funds all over the world.

Uphold is a worldwide chief in buying and selling infrastructure, supporting the motion of worth between crypto and fiat and throughout networks.

“The Uphold platform encompasses a totally automated, high-frequency buying and selling stack linked to 30 underlying buying and selling venues permitting us to supply deep liquidity, a number of execution paths for transactions, and exceptionally tight spreads,” Simon McLoughlin, Uphold’s CEO stated concerning the partnership.

Ripple has continued to develop its cross-border funds infrastructure internationally supported by the On-Demand Liquidity (ODL) product. Development in ODL may positively influence the worth of the native token, XRP used to facilitate transactions between sending and receiving events.

Associated Articles

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: