XRP, the token caught in a longstanding courtroom battle with america Securities and Alternate Fee (SEC), has rolled again to hunt assist and sweep by means of liquidity earlier than resuming the anticipated run-up to $1.

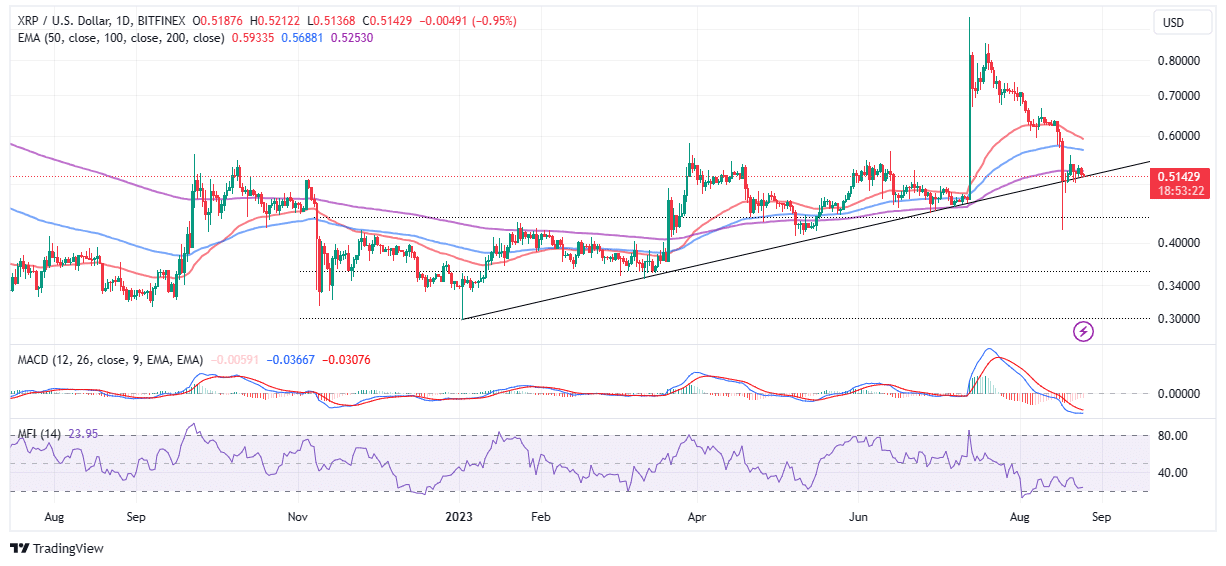

Down 2.3% on Friday, XRP is trading at $0.515 with $789 million in buying and selling quantity coming in. Offering fast assist to the cross-border cash remittance token is a multi-month ascending trendline, relationship again to the start of the yr.

Bulls have each motive to carry this assist intact, contemplating XRP is buying and selling under all the main shifting averages, together with the 50-day Exponential Shifting Common (EMA) (pink), the 100-day EMA (blue), and most significantly the 200-day EMA (purple) at $0.5253.

XRP On The Fringe of One other Downfall

XRP is again to buying and selling ranges final seen earlier than the July ruling within the Ripple vs. SEC case. After the courtroom dominated that secondary gross sales of XRP tokens on exchanges like Binance indicate that it’s not a safety opposite to gross sales made on to establishments.

Whereas this rule was a win for XRP, the exceptional rally that adopted the ruling shortly pale earlier than reaching $1. XRP achieved a brand new 2023 milestone at $0.93 in July and ever since, the token has been shedding floor.

Final week’s sell-off noticed XRP plunge under two essential assist/resistance areas at $0.6 and $0.5. The bearish candle wick stretched to $0.42, however a knee-jerk reflex response by the bulls pulled the worth above $0.5.

Merchants contemplating new positions in XRP should tread cautiously by ready for the development to substantiate earlier than firing up the orders. It’s too early to inform if the fifth-largest crypto will rebound from the ascending trendline towards the coveted $1, or prolong the declines to $0.42 or worse $0.3.

A bearish consequence with XRP losing ground is most likely if sellers insist on pushing for motion under the trendline or $0.5.

The Shifting Common Convergence Divergence (MACD) affirms the bearish outlook because it sustains a promote sign. Buyers ought to think about XRP an asset price shorting so long as the MACD line in blue holds under the sign line in pink.

Any try to make a fast rebound is certain to face main challenges, particularly with the Cash Circulate Index (MFI) caught near the oversold space. This reveals that the inflow of funds into XRP markets falls quick in comparison with the outflow quantity. In different phrases, the momentum shouldn’t be sufficient to maintain the token on an uptrend.

That mentioned, quick positions in XRP are more likely to keep worthwhile over the weekend, however merchants must be vigilant and maintain an open thoughts for a doable bounce to $0.6 if the MACD flips bullish and sends a purchase sign.

Will Robinhood Listing XRP?

Rumors have this week elevated hypothesis over the American digital asset buying and selling app, Robinhood itemizing XRP earlier than the tip of 2023. Many believed such information would tremendously profit Ripple’s cost system’s native token, which has dropped to pre-judgment ranges.

Robinhood will ultimately checklist $XRP quickly and it’ll inexperienced mild us to $10+ 😎

🚀🚀🚀🚀🚀#XRP🚀🚀🚀🚀🚀

— XRP whale (@realXRPwhale) August 21, 2023

The hypothesis began with an nameless report from an alleged insider. Because the court battle between the SEC and Ripple rages on, it’s regular for the neighborhood to hope for one more catalyst that would set off one other value rally.

Associated Articles

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.