XRP, the Ripple-backed cryptocurrency, just lately witnessed vital exercise as a whale offloaded a considerable quantity of cash to centralized exchanges. On-chain statistics revealed that just about 31 million XRP cash have been dumped amid the latest worth restoration throughout the previous 24 hours. This motion as each different whale exercise has equally raised considerations amongst buyers concerning the long run worth motion of the asset.

XRP Whale Exercise and Market Influence

Large token dumps to exchanges are sometimes perceived as bearish market indicators, as they improve provide and might negatively influence costs. In line with knowledge from Whale Alert, an on-chain transaction monitoring platform, a widely known XRP whale transferred 30.350 million XRP to 2 centralized exchanges (CEXs) prior to now day.

This vital motion valued at $14.53 million was primarily directed to Bitstamp, a Luxembourg-based crypto trade, signaling elevated promoting strain. These transactions have sparked bearish sentiments amongst crypto market contributors, as such large-scale gross sales typically result in worth declines. The promoting strain created by these dumps can disrupt market equilibrium and result in heightened volatility.

Additionally Learn: Binance Announces ZKsync (ZK) Listing, Heres All

Present Market Situations and Future Prospects

As of the newest replace, the value of XRP stands at $0.4872 with a 24-hour buying and selling quantity of $661,747,811.30, reflecting a -0.38% decline during the last 24 hours and a -2.04% decline over the previous week. With a circulating provide of 56 billion XRP, the cryptocurrency’s market cap is valued at $27 billion. Regardless of the latest worth dip, the market has proven indicators of resilience, partly influenced by optimistic information surrounding the XRP Ledger (XRPL).

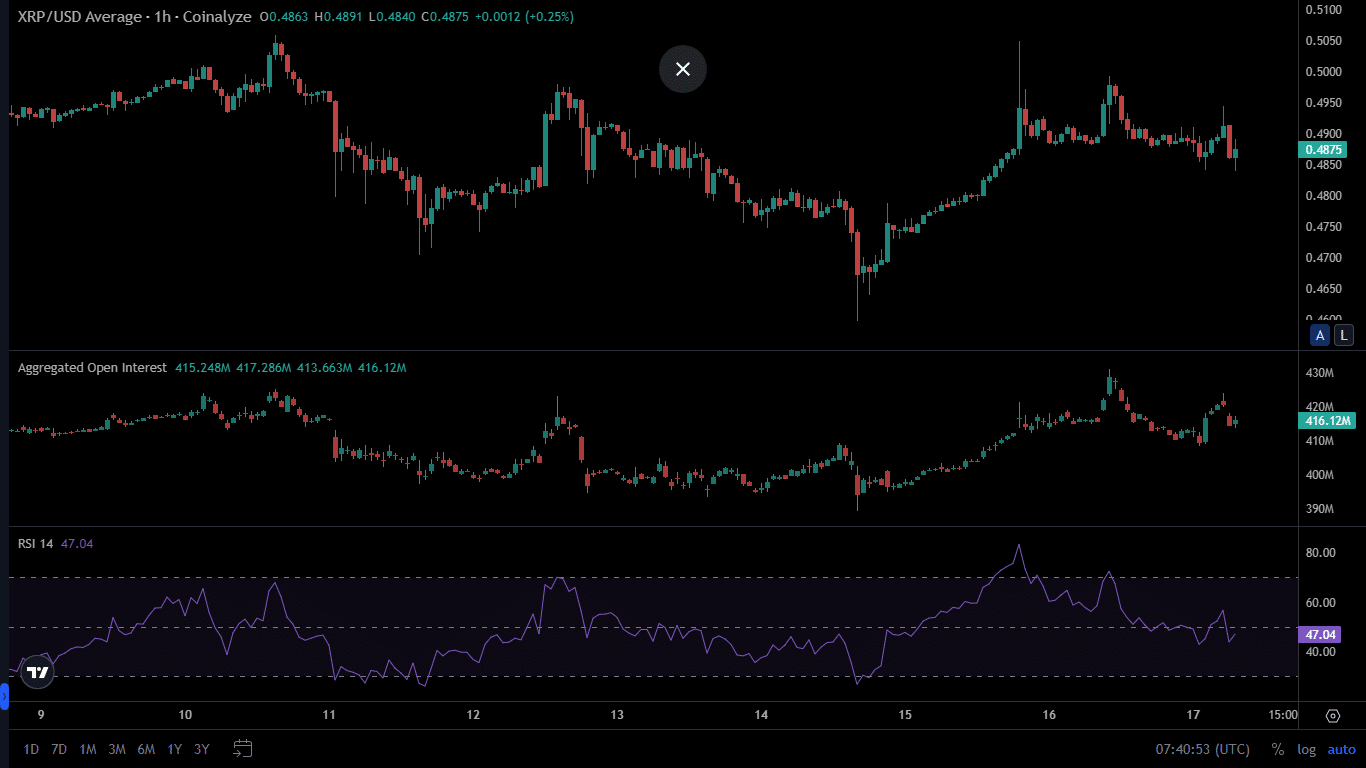

Ripple’s discussions to introduce a brand new stablecoin, RLUSD, geared toward stabilizing transactions throughout the XRPL, have contributed to a cautious optimism amongst buyers. Moreover, the futures open interest (OI) noticed a 0.21% improve, reaching $416.1 million, whereas the derivatives quantity jumped by 5.16%, indicating blended market sentiments.

These metrics counsel that whereas buying and selling exercise within the futures market has slowed, total curiosity in XRP stays strong. The Relative Strength Index (RSI) hovering close to 47.04 highlights the draw back strain on XRP, suggesting potential turbulent actions forward. Ought to the RSI go up into oversold territory, XRP might expertise a major worth rebound.

Additionally Learn: Aptos Will Flip Solana In Two Years As No.2 Layer-1, Says BitMEX CEO Arthur Hayes

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: