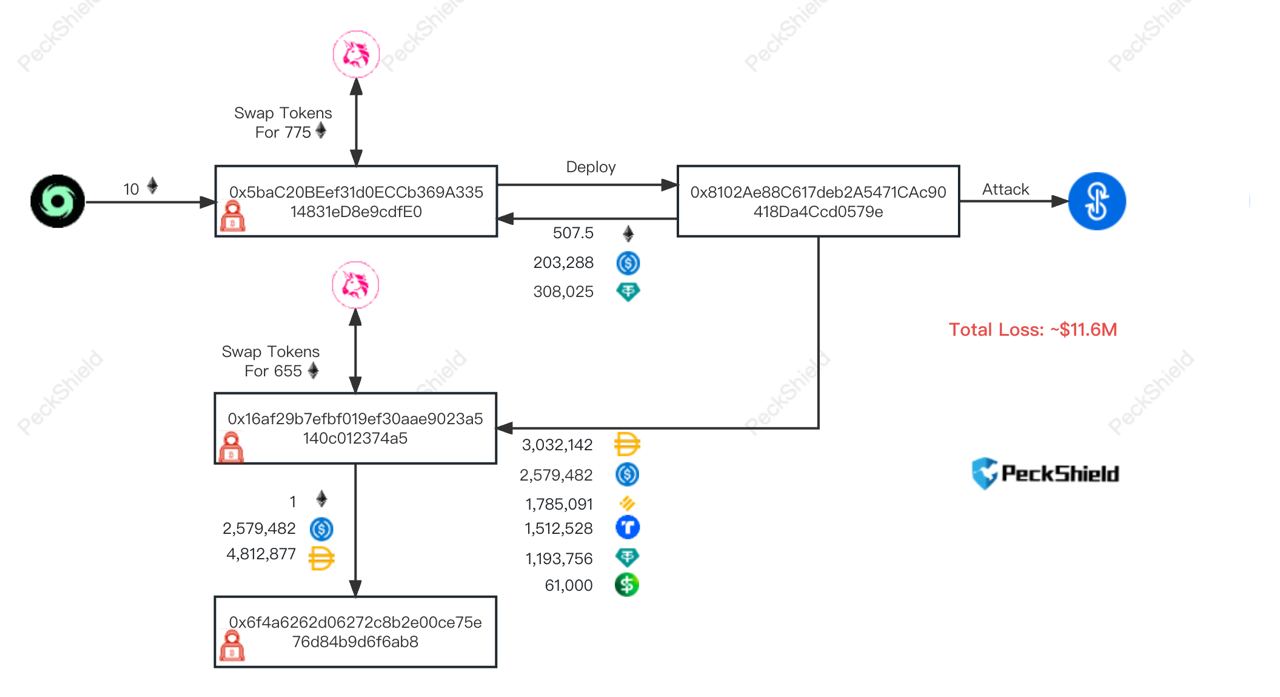

DeFi platform Yearn Finance has suffers a flash mortgage assault, with thousands and thousands of funds withdrawn by the hacker. The exploit is focused on Aave V1 liquid protocol, blockchain safety agency PeckShield reported on Thursday. Yearn safety group is conscious of the difficulty and dealing on a repair.

PeckShield in a subsequent tweet revealed that the basis trigger is probably going as a result of misconfigured yUSDT, which is exploited to mint enormous yUSDT (approx. 1,252,660,242,212,927.5) from simply $10K USDT. The large yUSDT is then cashed out by swapping to different stablecoins. Nonetheless, it must be confirmed if Aave has any function within the hack.

Additionally Learn: Ethereum (ETH) Withdrawn After Shanghai (Shapella) Upgrade: Details

Beosin Alert noted that the whole loss within the Yearn Finance hack is sort of $11,539,783. The blockchain safety platform additionally reported the wallets having essentially the most stolen funds from Yearn Finance. It additionally confirmed withdrawals of 996k USDC, 570k DAI, and 241k USDT from Aave Lending Pool Core V1.

Hackers grabbed almost $11.6 million price of stablecoins, together with 61K USDP, 1.5 million TUSD, 1.8 million BUSD, 1.2 million USDT, 2.58 million USDC, and three million DAI. The hackers transferred 1.5 million TUSD to AAVE, and borrowed 634 ETH from AAVE. They then swapped some stablecoins for 600 ETH, with 1,000 ETH already transferred into Twister Money.

Aave Not Impacted By Yarn Finance Hack

Crypto researcher Samczsun claimed that Yearn Finance’s model of USDT, referred to as yUSDT, has been damaged because it was deployed round three years in the past. He stated it was “misconfigured to make use of the Fulcrum iUSDC token as an alternative of the Fulcrum iUSDT token.”

Aave group confirmed that the Aave V1 protocol was used however is just not impacted by the hack. Aave CEO Stani Kulechov took to Twitter to substantiate this.

We’re conscious of this transaction, and it didn’t have an effect on Aave V2 and Aave V3.

We at the moment are confirming whether or not there’s any impression on Aave V1, the oldest model of the protocol which has been frozen. We’re monitoring the scenario carefully to make sure no additional considerations. https://t.co/uM9wtLNJMl

— Aave (@AaveAave) April 13, 2023

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.