ZIL, the utility token of the permissionless blockchain Zilliqa, has seen its value lower by 37.29% this 12 months. Whereas holders could also be hoping for a restoration, evaluation means that decline might proceed for a while.

In March, the token reached a yearly excessive of $0.040. However revisiting the area could possibly be a troublesome job, and right here is why.

Zilliqa Bears Preserve Management Regardless of Rising Consideration

As of this writing, ZIL’s value is $0.016. On the day by day chart, it trades beneath the 20 EMA. EMA stands for Exponential Transferring Common and is a technical indicator that tracks value adjustments of an asset inside a set interval.

In easy phrases, when a cryptocurrency’s value is above the EMA, the development is bullish. Conversely, if the value falls beneath the EMA, the development is bearish. The ZIL/USD chart reveals that the value remained above the 20 EMA till July 30.

The position at the time improved the hopes of recovery. Since it’s now beneath it, that hope might have been shattered as ZIL might proceed to development downwards.

Learn extra: Zilliqa (ZIL) Staking: A Step-by-Step Guide for Beginners

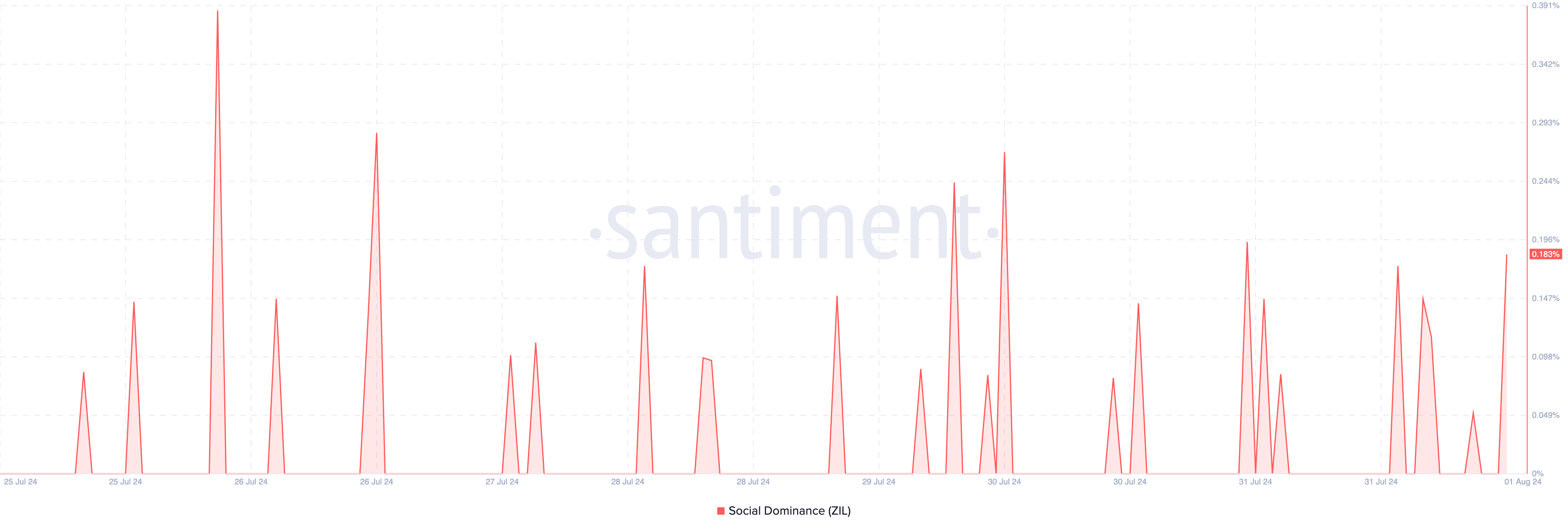

Regardless of the decline, Zilliqa’s social dominance has spiked. The social dominance metric compares the speed of discussions round a cryptocurrency to that of different tasks.

An increase in social dominance implies that crypto is getting a great dose of media protection. Alternatively, a decline implies that different cryptocurrencies are getting extra recognition.

Due to this fact, ZIL’s present situation aligns with a rise in messages and posts associated to it. Whereas ZIL could also be receiving a comparatively good degree of market consideration, this doesn’t validate a value improve.

ZIL Worth Prediction: Additional Correction Forward

Additional evaluation of ZIL’s value motion reveals that the token may experience consolidation over time. One of many grounds for this thesis is the Superior Oscillator (AO). The AO compares the lengthy and short-term value motion of a cryptocurrency to find out momentum.

When the indicator is above the midpoint, it implies that momentum is growing upwards. Nonetheless, if the studying is within the crimson area, it suggests growing downward momentum. The latter is the case with ZIL, particularly with the looks of a crimson histogram bar.

As well as, ZIL might battle to exit the downturn. If promoting strain will increase, the value might drop to $0.015. Failure to defend this level may drive a correction to $0.012, particularly if Bitcoin’s (BTC) price continues to fall.

Learn extra: Zilliqa (ZIL) Price Prediction 2024/2025/2030

Nonetheless, the token might evade reaching these targets if shopping for strain will increase. Ought to that be the case, ZIL’s value might drop to $0.17.

Disclaimer

Consistent with the Trust Project pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.